CME Shifts to 24-Hour Trading, Will It Reshape the Crypto Market?

The Chicago Mercantile Exchange (CME) in the United States is set to transition its cryptocurrency derivatives to a 24-hour, 365-day trading system, further blurring the boundaries between traditional finance and digital asset markets.

According to investment media outlet FXStreet on February 20 (local time), CME Group announced that it plans to expand operating hours starting May 29 to allow regulated cryptocurrency futures and options products to be traded around the clock. The move is subject to regulatory approval, and a minimum two-hour system maintenance window will be maintained on weekends. Trades executed on weekends or holidays will be processed on the next business day for clearing, settlement, and regulatory reporting purposes.

The measure will be implemented on CME’s electronic trading platform, CME Globex. Unlike traditional markets with limited trading hours, the initiative aims to provide a continuous trading environment tailored to the nature of the cryptocurrency market, enabling both institutional and retail investors to manage risk without time constraints. Tim McCourt, Global Head of Equity, FX, and Alternative Products at CME Group, stated, “By providing always-on access to regulated cryptocurrency products, customers can manage their exposure at any time.”

CME has expanded its product lineup since launching Bitcoin (BTC) futures in 2017. It currently offers standard and micro futures and options linked to major tokens, including Bitcoin, Ethereum (ETH), Solana (SOL), XRP (Ripple), Cardano (ADA), Chainlink (LINK), and Stellar Lumens (XLM). A standard Bitcoin futures contract represents 5 BTC per contract, while a micro contract is one-tenth that size. Micro products have also been introduced for some altcoins, allowing for more granular position management.

Trading volumes have also grown rapidly. According to CME, the notional trading volume of cryptocurrency futures and options surpassed $3 trillion in 2025. The figure reached an all-time high amid increased institutional participation, a trend that has continued into 2026. McCourt noted, “Demand for risk management in digital asset markets is at an all-time high.”

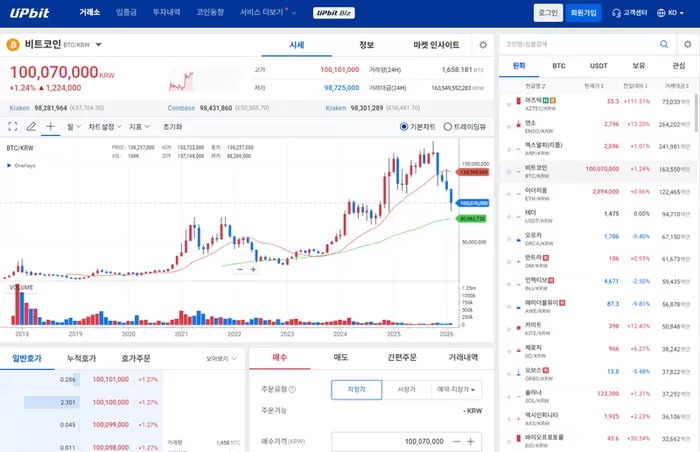

The announcement comes as the cryptocurrency market faces a downturn. The total crypto market capitalization has declined from its peak of $4.1 trillion in October last year to around $2.3 trillion recently, while Bitcoin has fallen to the $67,000 level. Amid heightened market volatility, attention is focused on how 24-hour trading of regulated derivatives may affect liquidity stability and price discovery.

*Disclaimer: This article is for investment reference only, and we are not responsible for any investment losses incurred based on it. The content should be interpreted for informational purposes only.*  <저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

|