Kospi Soars Past 5,600—Why Can’t Bitcoin Break 100 Million Won?

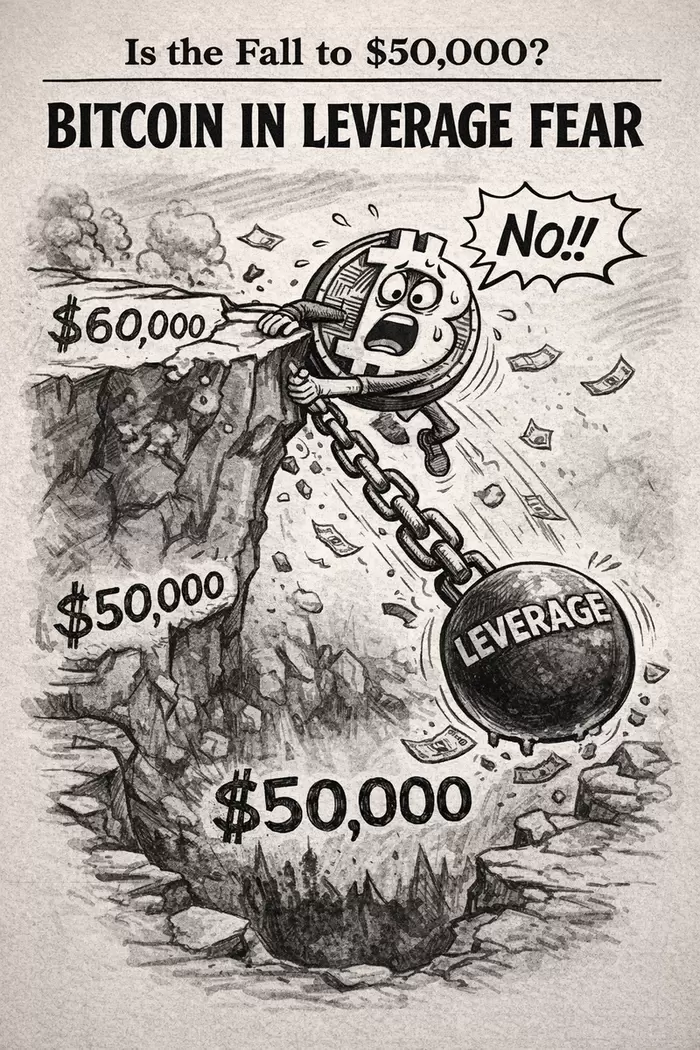

In stark contrast to the Korean stock market, where the KOSPI surpassed the 5,600 level for the first time in history and the KOSDAQ surged enough to trigger a sidecar, the virtual asset market remains trapped in a heavy slump. Bitcoin (BTC) has failed to reclaim the 100 million won support level, and investor sentiment continues to linger in a state of “Extreme Fear.”

[Coin Market] Bitcoin Below 100 Million Won Lacks Rebound Momentum

As of 4:13 p.m. on the 19th, according to global market tracker CoinMarketCap, the total cryptocurrency market capitalization stood at $2.31 trillion, down 1.21% from 24 hours earlier. The “Fear & Greed Index,” which measures investor sentiment, fell further to 11 from 12 in the morning, deepening the “Extreme Fear” mood.

Market leader Bitcoin (BTC) was trading at $67,058.40, down 1.00% over the past 24 hours, barely holding above the $67,000 level. On Upbit, a major domestic exchange, Bitcoin was up 0.58% from the previous day at 99,198,000 won, but still below the key psychological threshold of 100 million won. Bitcoin’s 24-hour trading volume on Upbit stood at approximately 164.2 billion won.

Altcoins also showed weakness. On CoinMarketCap, second-largest cryptocurrency Ethereum (ETH) fell 0.96% to $1,981.00, Solana (SOL) dropped 2.98% to $82.30, and Ripple (XRP) declined 3.81% to $1.42. Meme coin leader Dogecoin (DOGE) also slipped 2.72% to $0.09819.

However, on Upbit, some altcoins posted strong individual performances. Injective (INJ) surged 11.90% to 4,948 won, Kite (KITE) rose 5.28% to 339 won, and SonicSVM (SONIC) gained 6.96% to 75.3 won. In contrast, Cyber (CYBER) fell 6.72%.

[Reasons for Decline] Record-Breaking Rally in KOSPI and KOSDAQ... Why Were Coins Left Behind?

The sluggish performance of the crypto market stood in sharp contrast to the historic surge in the Korean stock market, which reopened after the Lunar New Year holiday. The KOSPI soared 3.09%, surpassing 5,600 for the first time, driven by massive net purchases worth 1.6 trillion won by institutional investors. The KOSDAQ jumped 4.94%, even triggering a buy-side sidecar. With Samsung Electronics reaching a historic 190,000 won per share and global funds concentrating on AI hardware and semiconductor sectors, bullish momentum swept the domestic stock market.

However, this renewed appetite for risk assets did not extend to cryptocurrencies. The primary reason appears to be lingering concerns over a potential “rate hike scenario” raised in the minutes of the U.S. Federal Open Market Committee (FOMC). While clear earnings improvement expectations in the semiconductor sector helped equities shrug off macroeconomic headwinds, the crypto market—highly sensitive to interest rates and liquidity—was directly hit by tightening concerns.

In addition, delays in reaching agreement on cryptocurrency market structure legislation in the United States, including the “Clarity Act,” have prolonged regulatory uncertainty. As a result, institutional capital has hesitated to enter the crypto market, instead flowing into equities, deepening the supply-demand imbalance or “decoupling.”

[Outlook] Prolonged Range-Bound Trading Expected... Urgent Need for Regulatory Breakthrough

Experts predict that Bitcoin will likely continue its sluggish sideways movement in the upper $60,000 range for the time being. For the rally in traditional financial markets, including the Korean stock market, to spill over into crypto as a trickle-down effect, a strong trigger such as a clear signal of rate cuts or improved regulatory clarity is needed.

In particular, without progress on altcoin regulatory legislation capable of attracting institutional investors, it may be difficult to reverse the current “Extreme Fear” sentiment and reclaim the 100 million won milestone. For now, the market is expected to remain driven largely by speculative trading focused on short-term volatility in select altcoins, as seen on exchanges like Upbit.

Disclaimer: This article is for investment reference purposes only. We are not responsible for any investment losses incurred based on this content. The information provided should be interpreted solely for informational purposes.  <저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

|