Bitcoin on $60,000 Alert Amid Middle East Bloodbath... ‘Seven Decisive Days’ After Five Straight Weeks of Losses

Bitcoin on $60,000 Alert Amid Middle East Bloodbath... ‘Seven Decisive Days’ After Five Straight Weeks of Losses

Bitcoin (BTC) has entered a record-breaking bearish phase, extending its decline for five consecutive weeks, as escalating military tensions in the Middle East and legislative outcomes in the United States emerge as decisive variables that could determine the fate of the cryptocurrency market.

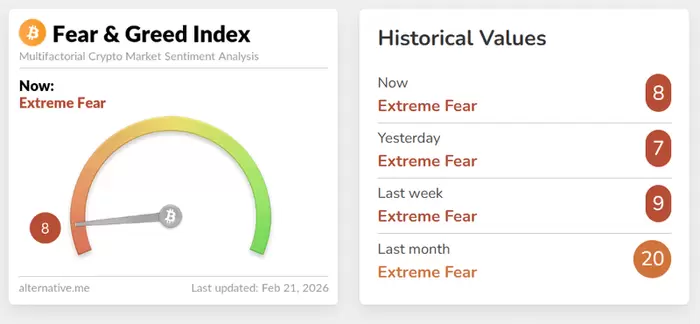

Guy Turner and Nic Puckrin, co-hosts of crypto-focused YouTube channel Coin Bureau, said in a video released on February 20 (local time) that Bitcoin has faced intense selling pressure after falling below its 100-week moving average. Turner noted that five consecutive weekly bearish candles have formed, signaling a sharp freeze in investor sentiment. He also highlighted that Bitcoin has been declining for five straight months on a monthly basis, while its value relative to gold has dropped for seven consecutive months for the first time in history, marking unprecedented bearish indicators.

Market analysts have identified the 200-week moving average, located between $55,000 and $60,000, as Bitcoin’s final support level and potential bottom. The macroeconomic environment remains unfavorable as well. The latest Personal Consumption Expenditures (PCE) price index came in above expectations, pushing anticipated Federal Reserve rate cuts further out to after June rather than earlier projections. The likelihood of prolonged high interest rates is weighing on risk assets such as cryptocurrencies and slowing their potential recovery.

Geopolitical risks in the Middle East represent the most significant threat fueling market fear. Turner and Puckrin expressed concern that the region is currently hosting the largest concentration of U.S. military forces since the 2003 invasion of Iraq, with 40% of early-warning aircraft fleets reportedly deployed, strongly suggesting the possibility of actual operations. There are also concerns that if President Donald Trump were to undertake sudden military action over a weekend when U.S. financial markets are closed, it could trigger a massive sell-off in the crypto market.

The only hopeful catalyst capable of reversing the sluggish market is the potential passage of the U.S. cryptocurrency market structure bill, known as CLARITY. Prediction markets currently estimate the bill’s approval probability at around 70%. However, disagreements persist between banks and industry players such as Coinbase over provisions that would allow stablecoin holders to receive interest through revenue-sharing mechanisms. Puckrin acknowledged concerns about accepting an imperfect bill but added that securing regulatory clarity through its passage could provide a powerful rebound momentum for the market.

Amid declining volatility and waning interest, some decentralized finance (DeFi) projects have quietly shut down services, illustrating that the market is currently in a period of endurance. Puckrin advised investors to focus on the bill’s fate by the end of February and closely monitor geopolitical developments while maintaining strict risk management. He emphasized that even during a prolonged downturn, maintaining personal well-being and a positive mindset is essential for long-term investment success.

Disclaimer: This article is for investment reference purposes only and we are not responsible for any investment losses arising from its use. The information provided should be interpreted solely for informational purposes.  <저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

|