“Will Fall Further Until Summer,” Warns Asset Manager Behind XRP Spot ETF

“Will Fall Further Until Summer,” Warns Asset Manager Behind XRP Spot ETF

A stark warning has emerged that the prolonged winter in the digital asset market could last until the summer of 2026 amid strong global macroeconomic headwinds. However, institutional investors are viewing the downturn as a buying opportunity, and expectations that XRP (Ripple), known for its strong utility, could surge to $10 in the long term are drawing significant attention.

In a recent appearance on the Hankyung Global Market YouTube channel, an official from a cryptocurrency spot exchange-traded fund (ETF) manager diagnosed that major digital assets, including Bitcoin (BTC), are likely to face further declines through this summer. He previously predicted October 2025 as the peak of the current cycle and noted that Bitcoin, which has fallen to around $60,000, could experience a deeper correction amid growing concerns about a macroeconomic slowdown. In particular, he advised caution against hasty short-term investments until full-scale monetary easing begins, as major central banks remain reluctant to cut interest rates due to inflation concerns.

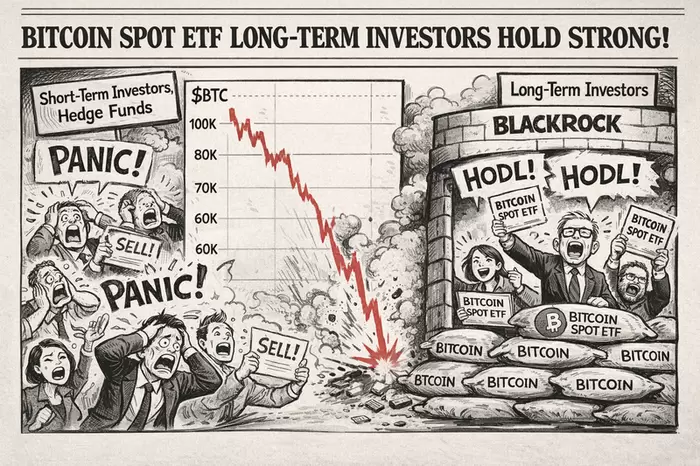

Despite the short-term bearish trend, market leadership is rapidly shifting from retail investors to institutions. With ETFs becoming mainstream, institutions and hedge funds prioritizing security and trading convenience are aggressively accumulating positions during the downturn. The ETF manager who participated in the interview also said he has moved away from directly holding coins and now manages 90% of his portfolio through ETFs, reflecting a long-term institutional investment perspective.

Although 2026 is expected to remain broadly bearish, projects with real-world utility—such as asset tokenization and stablecoins—are forecast to mark a year of innovation. He expressed strong confidence that XRP, currently hovering around $1, could reach $10 in the future based on its fundamentals. While there are currently insufficient signals of rate cuts from central banks to suggest an immediate buying point, he explained that current price levels present a highly attractive entry opportunity for long-term investors.

He also cited the successful case of ETFs offering staking rewards, such as those for Solana (SOL), and expressed expectations that XRP may introduce staking functions contributing to network growth in the future. He pointed to South Korea’s massive trading volume and the “Kimchi premium” as one of the greatest opportunities in the global market and called for clearer regulatory guidelines. As the next potential ETF candidates, he highlighted Sui (SUI), which is emerging as a strong competitor to Ethereum (ETH) and Solana, and gave high marks to the explosive growth potential of tokenization-related projects such as Injective (INJ) and Sei (SEI).

In conclusion, the trend of global sovereign wealth funds and pension funds allocating 1–3% of their assets to cryptocurrency ETFs is accelerating. Experts agree that rather than enduring the current downturn with excessive leverage, investors should take a long-term perspective by accumulating fundamentally strong assets at low prices in preparation for the coming wave of liquidity.

*Disclaimer: This article is for investment reference only and we are not responsible for any investment losses arising from it. The content should be interpreted for informational purposes only.*  <저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

최신기사

|