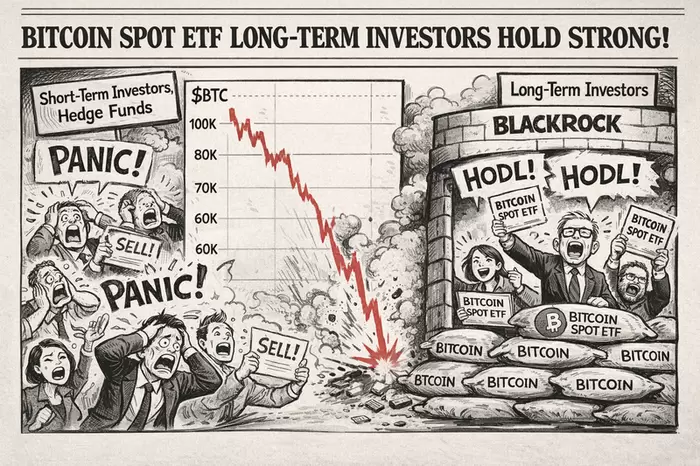

Is Retail Investors' 'Panic Selling' the Perfect Bottom Signal? Will the $100,000 Era for Bitcoin Return?

Is Retail Investors' 'Panic Selling' the Perfect Bottom Signal? Will the $100,000 Era for Bitcoin Return?

Renowned crypto bull Tom Lee has diagnosed the current extreme fear sentiment and investors’ rage quitting as a powerful bottom signal, predicting that Bitcoin (BTC) could soon stage a full-fledged surge.

In a recent interview, the Fundstrat founder viewed the market’s deep pessimism as a positive sign. He noted that historically, moments when investors give up on Bitcoin in anger and exit the market have consistently marked perfect bottoms. He also analyzed that Ethereum (ETH) is likely to have formed its final low around $1,890 and could rebound from that level.

Lee also dismissed concerns about Bitcoin’s underperformance compared to the recent surge in gold prices. He emphasized that since 1971, gold has underperformed inflation 48% of the time, while Bitcoin has outpaced inflation 97% of the time since its inception. With gold’s market capitalization having swollen to $40 trillion, he argued that Bitcoin still holds an overwhelming advantage as a long-term store of value.

He further assessed that the macroeconomic environment is becoming favorable for the crypto market. The nominee for the next Federal Reserve chair, Kevin Warsh, is reportedly inclined toward balance sheet reduction alongside lower interest rates, a dovish stance that could provide a positive liquidity environment for risk assets such as stocks and cryptocurrencies.

From a technical analysis perspective, strong upward momentum is also said to be imminent. Crypto analyst Jonathan Shyader stated that significant short liquidity is concentrated between $71,000 and $72,000. If Bitcoin breaks through this range, a large-scale short squeeze could propel prices past $76,000 and potentially trigger a vertical rally toward $84,000.

He added that if Bitcoin surpasses $100,000, it could mark the end of the prolonged bear market and reach as high as $200,000 by year-end. However, he cautioned that geopolitical risks among the U.S., China, and Iran, as well as uncertainty over the pace of interest rate cuts, remain factors that could cause additional short-term volatility accompanied by long position liquidations before a full-scale rebound.

Disclaimer: This article is for investment reference only and the publisher is not responsible for any investment losses incurred based on it. The content should be interpreted for informational purposes only.  <저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

최신기사

|