Bitcoin Stumbles at $70,000 Threshold as Buying vs. Selling Battle Continues

Bitcoin Stumbles at $70,000 Threshold as Buying vs. Selling Battle Continues

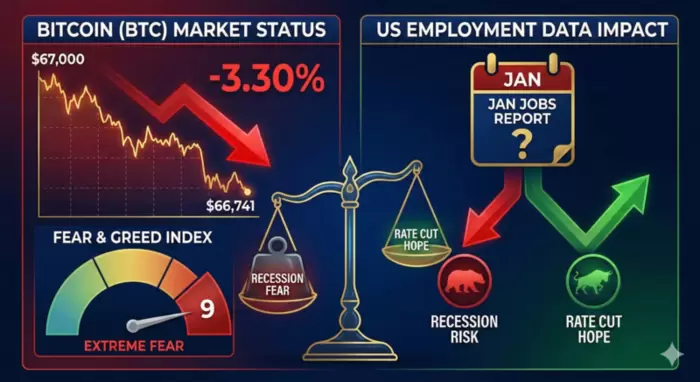

Bitcoin (BTC) has failed to stabilize after reclaiming the $70,000 level, leading to a sharp contraction in investor sentiment. Intense buying and selling battles are continuing around key technical support levels.

According to crypto-focused media outlet NewsBTC on February 11 (local time), Bitcoin recently faced renewed downward pressure after its attempt to recover the $70,000 mark was unsuccessful. After plunging to the low $60,000 range last week, Bitcoin rebounded sharply on Friday to surpass $70,000. However, it lost upward momentum over the weekend and is currently trading between $68,000 and $69,000. The market’s Fear and Greed Index has fallen into the single digits, indicating extreme fear and reflecting heightened investor anxiety.

Technical indicators and movements in the futures market continue to suggest bearish dominance. Open interest has dropped sharply from $19 billion to $16 billion, signaling large-scale leveraged liquidations. Funding rates on major exchanges have fluctuated between neutral and negative territory, indicating that short positions are gaining the upper hand. In the short term, the $68,000 level serves as primary support. If this level breaks, there is a risk of further decline toward the $65,000 area, where additional liquidity may be sought.

Key factors behind the recent decline include macroeconomic uncertainty and profit-taking by institutional investors. Strategy Chairman Michael Saylor continues to encourage Bitcoin purchases, but the market is closely watching the company’s holdings of approximately 700,000 BTC, which are currently showing an average unrealized loss of about 10%. The partial fading of policy-driven optimism following the election of U.S. President Donald Trump has also weakened upward momentum, adding pressure to prices.

On the other hand, inflows into spot Bitcoin ETFs continue to provide a strong line of defense against further downside. Last Friday alone saw net inflows of approximately $350 million, suggesting that institutional investors are buying the dip. Crypto analysts note that as long as Bitcoin remains above the 200-week moving average of $58,000, the possibility of a long-term recovery remains intact. In particular, a decisive break above the $75,000 resistance level could signal that the downtrend has fully ended.

Major altcoins such as Ethereum (ETH) and XRP are also showing weakness in line with Bitcoin’s price movement. XRP has fallen nearly 70% from its recent peak and is consolidating around the $1.40 level, while Ethereum is focusing on holding the $2,000 support line. Market participants are closely monitoring progress on U.S. cryptocurrency market structure legislation and changes in macroeconomic indicators as they wait for liquidity to recover for Bitcoin’s renewed attempt to reclaim $70,000.

*Disclaimer: This article is for investment reference only, and we are not responsible for any investment losses resulting from it. The content should be interpreted solely for informational purposes.*

<저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

|