Aftermath of Bithumb Incident: On-Site Inspections Launched for Upbit and Coinone

Aftermath of Bithumb Incident: On-Site Inspections Launched for Upbit and Coinone

The asset management systems of virtual asset exchanges have come under close scrutiny by financial authorities. Following Bithumb’s erroneous Bitcoin distribution incident, lawmakers have officially raised the need to mandate a monitoring system that compares exchange-held assets with ledger balances in real time.

At a pending issues inquiry session of the National Assembly’s Political Affairs Committee on February 11, Lee Chan-jin stated, “The balances held by virtual asset exchanges and their ledger quantities must match in real time,” adding, “Even Upbit’s five-minute interval reconciliation system cannot be considered a short period.” He emphasized, “To ensure system safety, actual held assets and ledger records must be immediately synchronized.”

Chairman Lee referred to the 2018 Samsung Securities phantom stock incident, saying, “Samsung Securities revamped its system so that input exceeding the total number of issued shares would be impossible,” and added, “Virtual asset exchanges likewise require structural controls at a comparable level.” Regarding calls to restrict business approval for operators that have not adopted a ‘proof-of-reserves system’ used overseas, he commented, “The final decision will rest with the Financial Intelligence Unit,” but added, “We will carefully review the matter in consideration of current market conditions.”

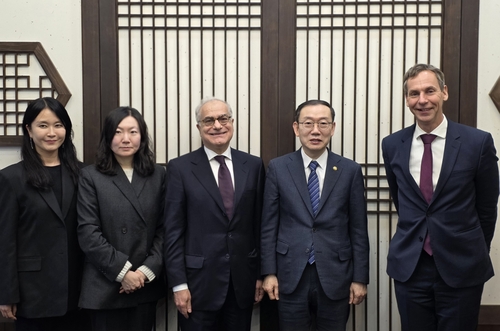

On the same day, the Financial Services Commission, the Financial Supervisory Service, and the Financial Intelligence Unit began on-site responses to inspect risks exposed by the Bithumb incident. Authorities will examine major exchanges—including Upbit, Coinone, Korbit, and Gopax—focusing on their asset verification systems and overall internal controls.

The inspection will be carried out mainly by an ‘Emergency Response Team’ formed jointly by financial authorities and the Digital Asset Exchange Alliance. Any deficiencies identified will be reflected in strengthened self-regulation measures by DAXA as well as in the second phase of virtual asset legislation. Measures under review include applying internal control standards equivalent to those of financial institutions to exchanges and mandating regular asset verification by external agencies.

In addition, discussions are underway on imposing strict liability for damages on exchanges in cases where users incur losses due to system failures or other incidents. Financial authorities have elevated the previous day’s on-site inspection of Bithumb to a formal examination, intensively reviewing user protection measures, compliance with anti-money laundering obligations, and whether abnormal transaction detection systems function properly in the event of large transactions.

*Disclaimer: This article is for investment reference only and we are not responsible for any investment losses arising from it. The content should be interpreted solely for informational purposes.*

<저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

|