TD Cowen hikes Strategy price target to $440 as shares jump

Amid Bitcoin’s ongoing downturn, Strategy has captured market attention as its stock surged sharply following a surprise upward revision to its price target by TD Cowen.

According to cryptocurrency-focused outlet CoinGape on February 6 (local time), investment bank TD Cowen assigned a Buy rating to Strategy, led by Executive Chairman Michael Saylor, and set a price target of $440. Analyst Lance Vitanza assessed that Strategy has ample capital strength to withstand further declines in Bitcoin. In particular, the company’s $2.25 billion in cash reserves are deemed sufficient to cover fixed expenses for the next 17 months and to repay $1 billion in convertible bonds maturing in September 2027.

Immediately following the announcement, MSTR shares jumped more than 20% from the previous close of $107, trading around the $128 level. The stock rebound coincided with Bitcoin reclaiming the psychological resistance level of $69,000 and rising more than 10%. Although Strategy recorded a $12.4 billion loss in the fourth quarter, which had weighed on its share price, TD Cowen’s positive outlook acted as a catalyst that rapidly restored investor confidence.

Vitanza predicted that Bitcoin would overcome the current downturn and potentially set a new all-time high as early as the third quarter. As a result, Strategy, which has high exposure to Bitcoin, is expected to be among the biggest beneficiaries. CEO Phong Le also reassured investors, stating that there is no risk of forced liquidation of the company’s holdings unless Bitcoin falls to $8,000. Chairman Saylor likewise reaffirmed his commitment to continue accumulating Bitcoin even during market downturns.

Supported by a broader recovery across the digital asset market, other related stocks also posted strong gains. Robinhood and Coinbase surged by 15% and 10%, respectively, while BitMine rose more than 15% as Ethereum recovered the $2,000 level. Experts note that Strategy’s stock, which had fallen to $106 the previous day, has effectively confirmed a bottom and still retains substantial upside potential.

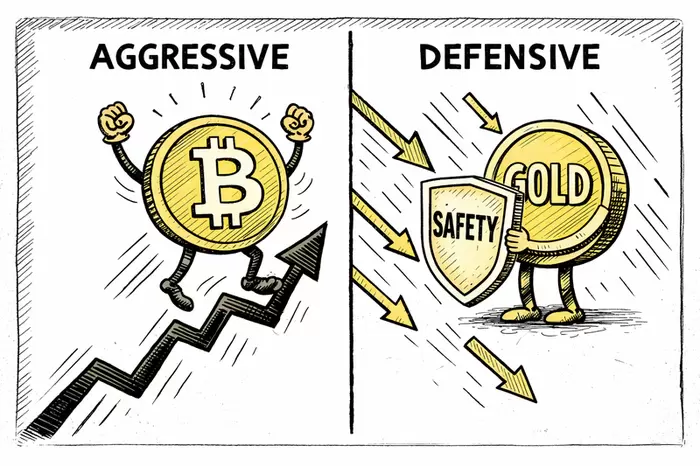

Strategy is solidifying its leading position in the digital asset market through its distinctive operating model that incorporates Bitcoin as a core corporate asset. TD Cowen noted that despite intensifying competition following the launch of spot Bitcoin ETFs, Strategy’s unique leverage strategy continues to offer strong appeal. Even amid uncertainty surrounding Bitcoin’s trajectory in the first quarter of 2026, Strategy is driving a reassessment of its corporate value based on a firm investment philosophy.

*Disclaimer: This article is for investment reference only, and no responsibility is assumed for investment losses based on its content. The information should be interpreted solely for informational purposes.*

<저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

English 많이 본 기사

2

|